Dufur Budget Committee

Member | Term Ends |

Steve Podvent | 6/30/2024 |

Bert Wyatt | 6/30/2024 |

Cindy Johnson | 6/30/2025 |

Kathy Bostick | 6/30/2026 |

Shelly Hunt | 6/30/2026 |

Budget Committee Minutes

DUFUR SCHOOL DISTRICT

Budget Committee

May 13, 2024

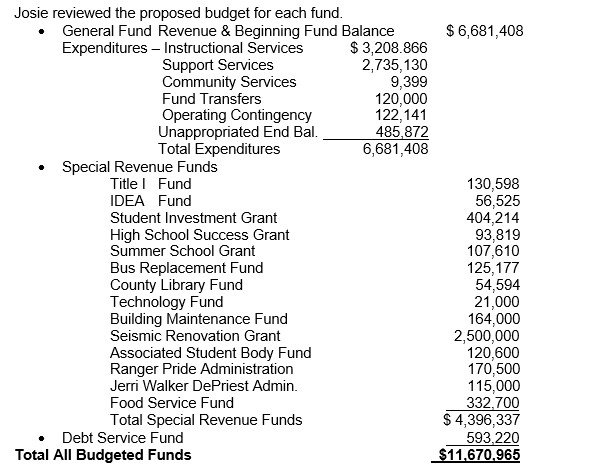

The Budget Committee met May 13, 2024, to receive the budget message and proposed budget for the 2024-25 school year. Board Vice-Chair Janna Hage called the meeting to order at 6:08 P.M. Board and Budget Committee Members present Bert Wyatt, Steve Podvent, Shelly Hunt, and Tim Fain. Staff present: Jack Henderson, Josie Turner, and Board Secretary Virginia Albrecht.

Election of Officers

Shelly Hunt volunteered to be Chairperson. Bert Wyatt volunteered to be Vice-Chair. Steve Podvent moved a unanimous ballot to be cast.

Budget Message – Jack presented the budget message stating the Governor’s and Co-Chair’s proposed budget once again is not adequate to support the cost of K-12 education. During 2023/24 the district received $10,532.12 per ADMw from the State School Support Fund. Current projections for 2024/25 are $11,637.00 per ADMw, which includes the transportation grant. The 24/25 proposed budget includes cuts in general fund spending. To offset cuts, there are more grant dollars in the budget than ever before. Average Daily Membership rebounded during 23/24 back to 350 students which amounts to 471.2 ADMw.

The following facts impact the proposed budget currently:

Three elementary classes (1st, 3rd, and 5th) require splitting the class to best serve the student’s needs.

The district has made a strong investment in health services. This includes a full-time nurse and full-time counselor. The district also pursed grants to assist One Community Health to establish a School-Based Health Center located on campus that will be functioning when school opens in September 2024.

The Career Technical Education (CTE) program continues to grow and 24/25 will be paid out of the High School Success dollars.

The proposed budget provides a 4% pay increase for each employee, which will maintain a pay structure for all employees that will attract and maintain quality staff.

Revenue – These sources include property tax obtained through our permanent rate of 4.4659 per thousand dollars of assessed value, making up 25% of the General Fund budget. State School Support Funds provide the major portion of the district's operating revenue.

The district’s cash reserves increased during the 23/24 school year. The anticipated ending fund balance will be in the $600,000.00 range. Our auditing firm recommends a 12% reserve. This is an area the board will monitor and adjust as necessary in coming years.

Proposed Budget Reductions – If the State School Fund is reduced further additional cuts will be needed and will be enacted prior to the beginning of the 24/25 school year.

Reduce 1.5 FTE Certified Positions

Reduce 3.0 FTE Classified Assistant Positions

This is an ongoing process the next months to be fiscally responsible while maximizing quality academic programs.

Grant dollars included in this budget are:

Seismic Renovation Grant - $ 2,500,000.00. The seismic work includes reinforcement of the cafeteria, lower gym roof, and original locker rooms. Work is underway and will be completed in August 2024.

Student Investment Account - $404,000.00. This will be year four of this program funded by the (CAT) tax that the 2019 legislature passed. This is an ongoing grant program through ODE.

High School Success - $ 113,290.00. This is also an ongoing grant program through ODE that supports our CTE programs.

Impact Aide Funding - $60,000.00. This program assists with funding for students that live on non-taxed federal lands in the school district.

Early Literacy Grant – 43,391.17. The second year of this grant will help support early literacy learning.

Additional discussion included.

Technology Fund expenditures will include the replacement of classroom computers and laptops.

The Bus Replacement Fund will purchase a new 2024 school bus to replace the one that was totaled, plus make annual lease lease/purchase payments.

After review and discussion, Bert moved to approve the proposed budget for 2024-25, imposing the permanent rate of $4.4659 per $1000 of assessed value, and the general obligation bond levy of $516,600.00. Steve seconded the motion that carried unanimously.

Having no additional business, the meeting was adjourned.